When it comes to defining the Australian banking system, there are four banks that stand out - the big four.

These big four Australian banks consist of the Commonwealth Bank of Australia (CBA), Westpac Banking Corporation, National Australia Bank (NAB) and ANZ.

These banks work with the central bank and government to support the economy by maintaining credit growth and ensuring the financial system works efficiently.

COVID-19 has had an impact on banking profits, however the banks have identified opportunities to transform banking, with a focus on productivity and digitalisation.

With that in mind, let's take a look at the commonalities and differences between the banks and what they may offer you now and into the future that may help you decide which bank (no pun intended) best suits your needs.

Who are the big 4

Westpac Banking Corporation (the oldest bank in Australia), National Australia Bank (NAB), Commonwealth Bank (CommBank - the largest bank in Australia) and ANZ Banking Corporation are collectively known as the Big Four.

Why?

Well, they're the biggest banks in Australia.

What the big 4 banks offer

Each bank offers a range of transaction accounts, savings accounts, term deposit rates, loans and credit card options.

In terms of loans, the big four hold the majority of the market share, with the other 49 Australian banks trailing well behind.

Given their dominance in the loan space, they are seen as the safest banks to hold accounts with. Of course, all Australian banks are covered by the Government Guarantee, insuring your savings up to $250,000 per person, per institution should there be a financial crisis, so there is no real reason to feel unsafe with any other bank.

Each of the big four banks have Internet and mobile access. User experience does differ, so if this is a high priority for you, it would be worth checking out the apps to see how they best suit your needs.

CommBank's NetBank is highly regarded. InfoChoice comprehensively reviewed the app last year. CommBank also has the largest ATM network in Australia. In contrast, if you travel overseas on a regular basis and need access to your cash while travelling (something you can't do at the moment), Westpac allows you to access more than 50,000 global ATMs fee-free through the Global ATM Alliance.

Interest rates on savings and loans products vary between each bank and each product. If considering a place to stash your cash, a personal loan or mortgage, it is worth comparing these products.

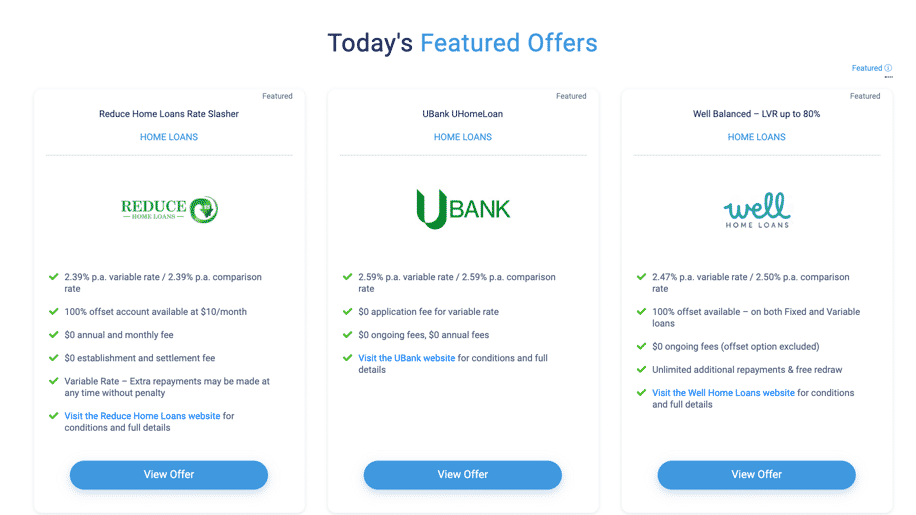

Take variable home loans for instance, Westpac offer a Flexi First Option Home Loan (Promo) - Principal & Interest (LVR up to 70%). The variable rate is 2.69% (comparison rate 2.70%). The

NAB Base Variable Rate Home Loan - Principal and Interest Special Offer LVR 80% has a variable rate of 2.69% (comparison rate 2.69%). The ANZ Simplicity PLUS P&I Special Offer (LVR not >80%) has a variable rate of 2.72% (comparison rate 2.76%). The Commonwealth's Extra Home Loan LVR <=70% (P&I) offers a variable rate of 2.79% (comparison rate 2.80%).

This is how they compare to InfoChoice's featured Home Loans:

As you can see, each bank offers a different rate, with different advantages.

Interestingly, the big four delivered aggregate housing loan growth of 1.5% for 1H20 compared to 1H19. Loan growth was underpinned by sustained growth in house prices, particularly in Sydney and Melbourne. These markets delivered double-digit growth over the 12 months to March 2020.

Due to COVID-19, the slowing housing market has seen banks become more cautious in assessing new loans, leading to tighter credit conditions, so make sure you compare properly and determine what you can afford.

Any comparison you make, should be made with your personal financial circumstances in mind. So determine what kind of mortgage suits including low interest, no fee, variable or fixed, or what kind of savings account you require including a high interest savings account or a low-fee everyday transaction account.

When it comes to savings accounts, the big four may not offer the best interest rates. Generally, they have the lowest interest rates of all banks. You want a higher rate for your savings account, so use your consumer power to get the best deal for yourself and look at what other banks have to offer. InfoChoice helps you compare a range of savings products here.

One further feature you may consider is whether the bank offers 24/7 customer service if you have a financial emergency.

Should you go with a big four bank?

The big four have a number of advantages and disadvantages. The bank you choose really comes down to what you are looking for in a bank. If you want the best interest rates on your savings accounts and term deposits, it may choose to look elsewhere. However, if you want easy access, 24/7 service and competitive mortgage rates, the big four provide excellent options.

In the end, it's up to you to weigh up the benefits against the disadvantages and make the decision that best suits your financial needs.

This update is not financial advice. This article is general news and information.

Home Loans: The comparison rates are based on a secured loan amount of $150,000 and a term of 25 years.

Personal Loans: The comparison rates in this table are based on a loan of $30,000 and a term of 5 years unless otherwise indicated in the product name with^, in which case, the comparison rate is based on a loan of $10,000 and a term of 3 years. The comparison rates are for unsecured personal loans only for the relevant amounts and terms. The comparison rates for car loans and secured personal loans are for secured loans unless indicated otherwise.

WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan. Comparison rates are not calculated for revolving credit products.

The products compared in this article are chosen from a range of offers available to us and are not representative of all the products available in the market and influenced by a range of factors including interest rates, product costs and commercial and sponsorship arrangements

InfoChoice compares financial products from 145 banks, credit unions and other financial institutions in Australia. InfoChoice does not compare every product in the market. Some institutions may have a commercial partnership with InfoChoice. Rates are provided by partners and taken from financial institutions websites. We believe all information to be accurate on the date published. InfoChoice strives to update and keep information as accurate as possible.

The information contained on this web site is general in nature and does not take into account your personal situation. Do not interpret the listing order as an endorsement or recommendation from us. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. If you or someone you know is in financial stress, contact the National Debt Helpline on 1800 007 007.