The budget is forecast to return to surplus - +$4.2 billion by 30 June - which is the first time since 2008.

However it's slated to go back to a small deficit of $13.9 billion for 2023-24.

The government is anticipating measures to improve the bottom line further by increased taxes for gas extraction companies, and introducing a 15% global and domestic minimum tax for large multinational companies.

Smokers are also being slugged with more indexation on their vice to an additional 5% each year for three years; menthol cigarettes are also slated to be banned.

However, unlike previous years, it was a pretty modest budget for personal finances with little in the way of headline-stealing policies.

And that's exactly what Australia needs because there is enough excitement elsewhere, with a housing supply crunch, inflation at 30-year highs, interest rate rises hitting mortgage holders hard, and forecasts of an economic slowdown over the next couple years.

Key highlights in personal finance

- From July 2023, up to $500 per household will flow through to energy bill relief.

- Those on Jobseeker will see their payment increase by $40 a fortnight; maximum age for collection over 9 months lowered to 55 from 60.

- Rent assistance boosted by 15%. Maximum rate for a single is currently $157.20/fn.

- Income tax cuts still a go from 2024-25 but little mention of it in budget.

Quiet on income tax cuts

The legislated tax cuts from the previous government are still going ahead from 2024-25, however Treasurer Jim Chalmers said this budget is more about "helping the vulnerable".

"There was no news about the Morrison government’s Stage 3 tax cuts – which remain legislated to come into effect on 1 July 2024 and which will largely benefit the most wealthy," said Mark Chapman, H&R Block's director of tax communications.

However, "most wealthy" includes those who have experienced bracket creep thanks to stronger wages growth over the past year or so.

Real wages - wages growth minus inflation - is still at decade-lows.

Scott Treatt, general manager of tax policy and advocacy at the Tax Institute, said it wasn't surprising the government was light on detail here.

"The near future provides the platform for mature discussions about tax reform. The Treasurer acknoledged that 'there are genuine structural challenges facing us into the future'," Mr Treatt said.

"Economic progress won't be sustainable without substantial tax reform."

The secret losers from the budget

Retirees' deeming rates

There was no mention of pensioners' deeming rates in this year's budget, which are frozen until 2024-25 - only a year away.

Deeming rates are for older Australians who rely on income from 'deemed' financial investments such as savings accounts and term deposits.

Services Australia adds this to pensioners' other income and applies the income test to work out the pension payment rate.

For a single, the first $56,400 of assets has a deemed rate of 0.25%, while anything over that is deemed at 2.25%.

Considering many savings accounts and term deposits earn north of 4.00% p.a., pensioners have been coming out ahead.

However, from next financial year, there could be a significant jump.

'Lamington' gone

The low-middle-income tax offset - LMITO or 'lamington' - was a product of the previous government, and provided an immediate cash back for salary earners to the tune of up to $1,500 at tax time.

Now that's been abolished, H&R Block's Mark Chapman called that a tax hike in disguise.

"It now appears clear that he won’t be reinstating the LMITO, which appears to have gone for good," he said.

"Many voters won’t cotton on to that fact until they come to lodge this year’s tax return and they notice that the size of their refund has dramatically shrunk."

However CPA Australia's Gavan Ord said this posed too much of an inflation risk.

"A sugar hit of spending for middle income households might’ve been politically popular but could have made inflation worse," Mr Ord said.

Taking credit for market forces and the RBA's work

The unemployment rate is at 50-year lows, and remains persistently low despite the RBA swinging the cash rate axe.

This was largely an effect of the cash rate remaining at 0.10% for 18 months, $188 billion in the Term Funding Facility, and $300 billion of bond intervention from the RBA to keep the economy greased during Covid.

Commodity prices have taken off thanks to global inflation pressures and the war in Ukraine, and wages growth means many salary earners have been pushed into higher tax brackets, which is a boon for the government.

As a result of this, inflation is also at 30-year highs and not forecast to return to normal (RBA forecasts) until 2025.

This is slightly at odds from Treasury estimates of 3.25% next year.

The Treasurer was bullish on the budget doing its bit to lower inflation - headline inflation that is - and said handouts were a way to get there.

Budget papers estimated relief such as for energy bills will lower headline inflation by three quarters of a per cent.

However, Dr Shane Oliver, chief economist at AMP, said the deficit for next year risks being too stimulatory.

"The new fiscal stimulus next financial year of $12 billion risks boosting demand and adding to inflation – but it’s hard to be adamant as overall the Budget is taking more out of the economy compared to the projections last October," Dr Oliver said.

He said despite better-than-expected forecasts from the Treasury, this won't mean much for the RBA, given underlying inflation will still be strong.

"With the Budget overall taking more out of the economy than it’s putting back in compared to what was projected last October, its hard to see significant implications for the RBA but it will be wary of the boost to households from the cost-of-living measures which could boost spending," Dr Oliver said.

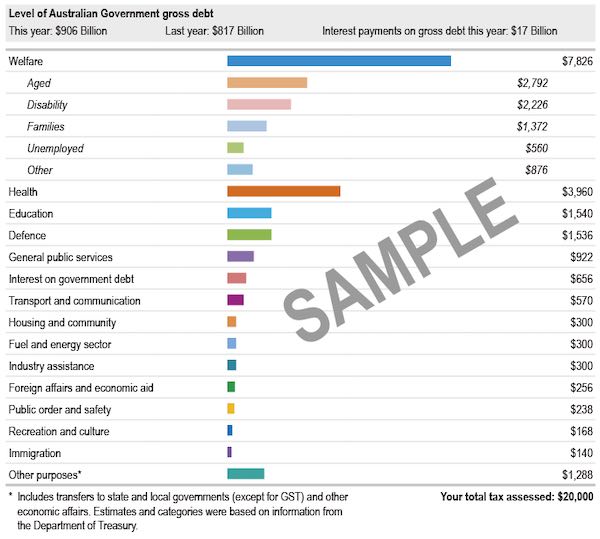

Spending more on government debt than the unemployed

Gilbert & Tobin partners reminded readers of the overall debt picture.

"It should not be forgotten that gross debt continues to be forecast to increase to over $1 trillion by 2025-2026, with net debt at $665.2 billion at the same time," they said.

This has real world consequences; someone earning the average (mean) full time wage currently sees $656 of their tax bill go towards repaying interest on government debt.

This is more than on the unemployed, federal police, federal housing, and the transport sector, and is expected to go higher now interest rates are higher.

However the Treasurer in his budget speech said lower debt and more prudent fiscal policy will reduce the interest costs by $83 billion over the next 12 years.