Heartland Finance is one of the largest providers of reverse mortgage products in Australia, and is now back-to-back winner of InfoChoice's Reverse Mortgage award, winning in 2020 and 2021.

Heartland Finance has helped more than 20,000 Australian seniors unlock the equity in their home to the value of more than $1.2 billion. This is in an industry with about $2.2 billion in reverse mortgages outstanding, making Heartland a primary player. Find out what Heartland has on offer in the reverse mortgage space below.

How do Heartland reverse mortgages work?

A Heartland reverse mortgage is for over-55s to release the equity in their home that they have built up over many years - without necessarily having to make regular repayments, and while continuing to live in the home.

As the name implies, the debt on a reverse mortgage increases over time as interest compounds. Debt is repaid from the future sale of the property, however you can make repayments at no penalty as well. Borrowers can choose to receive the loan as a lump sum payment, a regular income stream or as a cash reserve. The loan must be repaid within 12 months of moving permanently from your home.

A lot of retirees find themselves in the predicament of having a lot of their wealth tied up in the family home, yet having poor cashflow - asset rich, cash poor. The age pension alone likely doesn't cover enough to fund a comfortable lifestyle; it's also tough to know how much to drawdown in super, and other types of loans are unattractive.

Downsizing or moving to a retirement village can be unattractive propositions, so this is where Heartland fills a niche with its reverse mortgages. If done right, a reverse mortgage can be an effective tool at funding your retirement, living expenses, and improving your living standard as you get older.

How much can you borrow with Heartland?

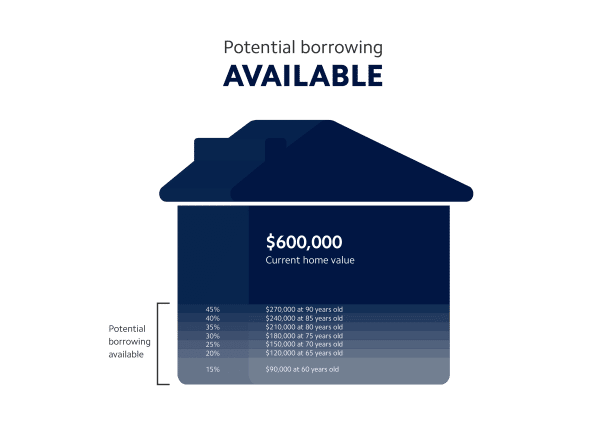

The amount borrowable is based on the customer's age and the value of their home. The younger the borrower, the lower the percentage they can borrow - this helps reduce the risk of the loan exceeding the home value as retirees get older.

Case Study - How Much Retirees Can Borrow

Bill and Jan are living in Ashgrove Queensland (4060) - a nice leafy part of Brisbane - in an old Queenslander they have fully paid-off, worth at current value $1 million. Bill is 72 and Jan is 70. Based on Jan's age (the youngest borrower), Heartland estimates they could borrow up to $300,000.

They decide to receive this money as regular payments to better fund a comfortable lifestyle, such as regular golf, dining out at restaurants, and annual holidays to Hamilton Island.

Heartland Reverse Mortgage Features

Choice of lump sum, cash reserve, or regular payment

There are three key options when drawing down on your equity with Heartland. As the name implies, lump sum is most straightforward - you receive your equity as cash to do what you like and you then repay interest on that cash. The other two are a bit more nuanced:

Advance payment - initial and regular

- The initial payment has a minimum drawdown of $5,000.

- A regular advance can be made monthly, quarterly or yearly for up to 10 years with a minimum drawdown of $300, $625 or $2,500 respectively.

Cash reserve or 'line of credit'

Using this option means money can be accessed via filing a request form, and interest isn't paid on the undrawn amount. The minimum drawdown is $2,500.

Aged Care Funding

Under Heartland's aged care reverse mortgage scheme, up to 50% of the value of the home could be used to pay for a Refundable Accommodation Deposit (RAD) or a Daily Accommodation Payment (DAP). The loan term is for five years.

30 Day Cooling Off Period

Heartland has a 30-day cooling off period so if you change your mind about the product you can withdraw and repay the loan at no cost. Heartland will refund the settlement fee, interest, and the standard cost of a valuation.

Equity Protection Option

This optional extra allows you to protect a certain portion of the net sales proceeds of your home up to 50%. When your loan is repaid, you or your estate are guaranteed to receive that portion, even if the balance on your loan is higher than this amount. Certain fees and charges for equity protection apply.

Variable interest rates and flexibility

Heartland's loan interest rate is variable, which means it's flexible with regards to repayments. With the variable loan term, you can make unlimited extra repayments at no cost. Or you can choose not to repay anything - the choice is yours.

Flexibility is one of the reasons as to why Heartland won InfoChoice's 2021 Reverse Mortgage Award.

Heartland Reverse Mortgage Pros

1. Tap into home equity and fund a better lifestyle

If you've been in your home for quite a few years, chances are it's appreciated in value quite a bit, and you're probably wondering how to make use of that equity. After all, it's just sitting there. By unlocking equity with a reverse mortgage, you can receive the money as a lump sum or regular repayment and use it as you see fit. This can be anything from life's necessities, to holidays, meals out, spoiling the grandkids and so on.

2. Make no repayments

Unlike a personal loan or regular mortgage, you don't have to make regular repayments. You can make them with Heartland with no penalty, but this removes the burden of having to repay debt at a time when you should be enjoying the fruits of your labour after many years in the workforce.

3. Stay in your home - fund aged care

Downsizing or moving into a retirement village are often touted as the two go-to options in retirement, but these can be unsatisfactory. Downsizing likely means dealing with the stress of buying and selling, and re-establishing yourself in a new community.

If you need it, with Heartland you also have the option of funding aged care requirements. Depending on the level of care, these often aren't cheap. Heartland provides a five-year loan term to receive a lump sum to pay for things such as a Refundable Accommodation Deposit or as a regular repayment to funding ongoing Daily Accommodation Payments.

This is one of the reasons as to why Heartland won InfoChoice's 2021 Reverse Mortgage Award, being one of Australia's only providers of specialist aged care reverse mortgage products.

4. No Negative Equity Guarantee (NNEG)

In 2012 the Australian Government introduced the No Negative Equity Guarantee for reverse mortgages. This ensures if the loan size outstrips the value of the home sale, the slack is picked up by the lender - not the borrower. This means if you move out or die owing more on the home than it's worth, you or your loved ones won't have to foot the bill.

Heartland Reverse Mortgage Cons

1. Higher interest rates

Reverse mortgages aren't like regular mortgages. Yes they are tied up in the family home, but interest rates are often higher - more akin to a personal loan than a regular home loan. This is also because of the NNEG mentioned earlier - the lender assumes more risk this way and charges higher interest accordingly.

Because you're not making regular repayments, it can also be hard to know how much the interest portion of the loan is impacting you.

2. Risk of house prices heading backwards

Chances are if you've owned your home for quite a while you'd have experienced solid capital growth. However, gains aren't guaranteed. House prices could fall, depending on what's happening in the wider economy and even in your neighbourhood. House prices falling could eat into your equity, and there's an admittedly small risk the loan could outsize the home value. Though, in this case you'd be protected under the NNEG.

3. You're leaving less when you die

If giving an inheritance to loved ones is important to you, a large part of wealth likely comes from the family home. With a reverse mortgage, when the borrower dies, the debt is recouped through the sale of the family home, and equity could have taken a hit with high interest rates. Of course, a large increase in property values could also negate much of this.

Photo by Ryan Reinoso on Unsplash