You could use so many metrics to determine which companies are the biggest in Australia. Do you measure by brand? If you do measure by brand, you would find that companies such as Woolworths was voted Australia's most valuable brand, with a brand value of AU$11.8 billion. Meanwhile, according to a Brand Finance research report, Optus is the country's strongest brand with brand strength index (BSI) score of 86.3 out of 100.

Good score.

The same report suggests Telstra's brand value has dropped 20%. It matters little to Telstra in the brand wars though as it only drops to the second most valuable after four years on top.

That's brand measurement, but what about the biggest private companies?

At the end of 2019, IBISWorld released its top list of private companies. Here are the top five:

- Visy $6.9 billion, up 3%

- Hancock Prospecting $6.08 billion, up 21.1%

- CBH Group $3.96 billion, up 6.6%

- Meriton $2.92 billion, up 5%

- HCF $2.86 billion, up 6.7%

Topping this list for the tenth year in a row was Anthony Pratt's recycling giant Visy Not far behind, as usual, was Gina Rinehart's Hancock Prospecting, thanks to rising iron ore prices.

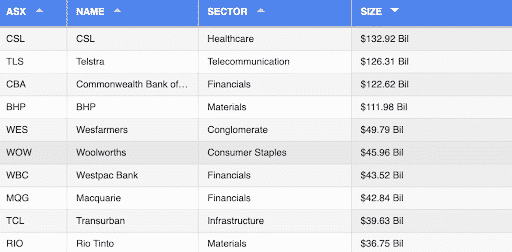

Here are the top 10 companies by market capitalisation. There are no real surprises, but it's great to see our biggest companies doing so well despite being hit by COVID-19.

Top 10 Australian companies by market cap

CSL Limited (ASX: CSL) : Market Cap - $132.92 billion

Sector: Healthcare - Industry: Biotechnology

Biotechnology company, CSL Limited develops products to treat and prevent serious human medical conditions. Its products include blood plasma derivatives, vaccines, antivenom, and cell culture reagents for medical and genetic research and manufacturing applications.

Telstra CORP (ASX: TLS) : Market Cap - $126.31 billion

Sector - Telecommunications

Australia's primary telecommunications and information services business was founded 1901 as Australian and Overseas Telecommunications Corp. Limited and changed its name to Telstra Corp. in April 1993. It has four divisions: Telstra Consumer and Small Business, Telstra Enterprise, Networks and IT, and Telstra InfraCo.

Commonwealth Bank (ASX: CBA) : Market Cap - $122.62 billion

Sector: Financials - Industry: Diversified Banks

The Commonwealth Bank of Australia (CBA or CommBank) is not Australia's oldest bank - although founded in 1911 it's pretty old - but it is Australia's largest bank. Its services expand to retail, business and institutional banking, funds management, superannuation, insurance, investment and brokerage services. It operates 1,172 branches and 3,963 ATMs in Australia.

BHP Biliton (ASX: BHP| LON BHP) : Market Cap - $105.52 billion

Sector: Basic Materials - Industry: Other Industrial Metals & Mining

BHP is a household name in Australia, having been founded in 1885 in Broken Hill in NSW. Simplistically, its success is based on the iron ore industry, which in early June had surged 5%, surpassing the US$105 per tonne mark. However, BHP operates in a range of industries including the exploration, production, and processing of minerals, including coal, iron ore, copper and manganese ore. It is also heavily involved with the exploration, production, and refining of hydrocarbons. Interestingly, the BHP Group 52-week high stock price is 59.02, which is 29.7% above the current share price of 49.72. This suggests the stock could be currently undervalued.

Wesfarmers (ASX: WES) : Market Cap - $49.79 billion

Sector: Consumer Cyclical - Industry: Home Improvement Retail

Wesfarmers Limited is involved in retail, chemicals, fertilizers, coal mining and industrial and safety products. It was founded as co-operative in 1914 and is now the largest employer in Australia with more than 220,000 employees. Brands under the Wesfarmers umbrella include Bunnings, Target, K-mart and Catch.com.au.

Woolworths Group (ASX: WOW) : Market Cap - $45.96 billion

Sector: Consumer Defensive - Industry: Grocery Stores

Woolworths Group Limited is a retail company operating supermarkets, liquor retailing, hotels and pubs and discount department stores. Some of the biggest brands under its umbrella include Woolworths supermarkets, BWS, Dan Murphy's and Big W.

Westpac Banking Corp (ASX: WBC) : Market Cap: $43.52 billion

Sector: Financials - Industry: Diversified Banks

Founded in 1817, Westpac Banking Corporation is Australia's oldest bank and provider of financial services. Westpac has 14 million customers across five divisions: consumer banking, commercial and business banking, wealth management, institutional banking, and Westpac New Zealand.

Macquarie Group (ASX: MQG) : Market Cap - $49.79 billion

Sector: Financials - Industry: Capital Markets

Macquarie Group Limited is an independent investment bank and financial services company. It employs more than 14,000 staff in 25 countries and is the world's largest infrastructure asset manager. It is also Australia's top-ranked mergers and acquisitions advisor, managing more than A$495 billion in assets. Macquarie is one of Australia's true success stories, having been founded in in 1969 as Hill Samuel Australia with a staff of just three. It is now a global business operating in over 27 countries.

Transurban (ASX: TCL): Market Cap $39.63 billion

Sector: Infrastructure

Transurban is one of the world's largest toll-road operators and designs and building new roads, whilst researching new vehicle and road safety technology. Transurban owns and operates 15 toll roads in Melbourne, Sydney, and the greater Washington area. Melbourne's CityLink is The company's biggest asset, which in 2018 accounted for approximately 32% of their total toll revenue.

Rio Tinto (ASX: RIO): Market Cap - $36.06 billion

Sector: Basic Materials - Industry: Other Industrial Metals & Mining

Like BHP, Rio Tinto Limited is a household name in Australia and is the Australian arm of the Anglo-Australian multinational metals and mining corporation. This is another company with a long history in this country having been founded in 1873. The company is a leader in the extraction of minerals, especially aluminium, iron ore, copper, uranium and diamonds.

This update is not financial advice. This article is general news and information.

Home Loans: The comparison rates are based on a secured loan amount of $150,000 and a term of 25 years.

Personal Loans: The comparison rates in this table are based on a loan of $30,000 and a term of 5 years unless otherwise indicated in the product name with^, in which case, the comparison rate is based on a loan of $10,000 and a term of 3 years. The comparison rates are for unsecured personal loans only for the relevant amounts and terms. The comparison rates for car loans and secured personal loans are for secured loans unless indicated otherwise.

WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan. Comparison rates are not calculated for revolving credit products.

The products compared in this article are chosen from a range of offers available to us and are not representative of all the products available in the market and influenced by a range of factors including interest rates, product costs and commercial and sponsorship arrangements

InfoChoice compares financial products from 145 banks, credit unions and other financial institutions in Australia. InfoChoice does not compare every product in the market. Some institutions may have a commercial partnership with InfoChoice. Rates are provided by partners and taken from financial institutions websites. We believe all information to be accurate on the date published. InfoChoice strives to update and keep information as accurate as possible.

The information contained on this web site is general in nature and does not take into account your personal situation. Do not interpret the listing order as an endorsement or recommendation from us. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. If you or someone you know is in financial stress, contact the National Debt Helpline on 1800 007 007.