June quarter GDP figures released on Wednesday showed overall GDP growth posted a +0.4% result - broadly in-line with forecasts - but per person it experienced a slump.

This was after posting a per capita -0.3% result in the March quarter, and a 0.0% result in the December 2022 quarter.

The population growth contributes to overall GDP growth but decreases the average per person, leading to a per capita slump.

Productivity is also down, with GDP per hour worked falling by 2.0% over the quarter, back to 2016 levels.

This is a concern for the RBA given unit labour costs rose, off the back of strong wages growth.

While the RBA held the cash rate for the third consecutive month yesterday, AMP Capital chief economist Dr Shane Oliver said there is a growing chance Australia could face a full blown recession.

"The pause in interest rates over the last three months comes after the biggest interest rate hiking cycle since the late 1980s. As is well known the late 1980s' tightening was a major contributor to the recession of the early 1990s," Dr Oliver said.

"The risks to the household sector are arguably higher now because household debt to income levels are three times greater than they were in the late 1980s."

Households saving less

The household savings ratio, a measure of income versus expenses, posted a result of 3.2%.

It was another decline after posting a 3.6% result in the March quarter which itself was a 15-year low and down from 4.4% in the December 2022 quarter.

“The fall in the household saving ratio was driven by higher interest payable on dwellings, income tax payable and increased spending by households due to the rising cost of living pressures," said Katherine Keenan, ABS' head of national accounts.

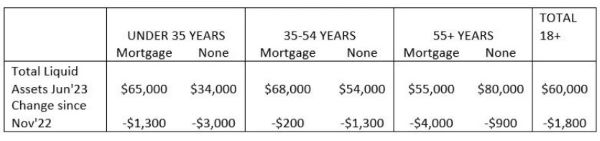

Research in early August from RFI Global indicates the average Aussie saw their average financial position decline $1,800 from November 2022 to June 2023.

Young Australians without a mortgage were worse off, down $3,000 on average:

Photo by Mads Schmidt Rasmussen on Unsplash