- New fintech platform allows employees to cash in on annual leave.

- Any leave balance above four weeks/20 days can be cashed in, capped at two weeks per year - if someone had seven weeks they could cash in only two weeks, for example.

- Subi could also help smaller companies better manage cash flow, avoiding large lump sum leave payments.

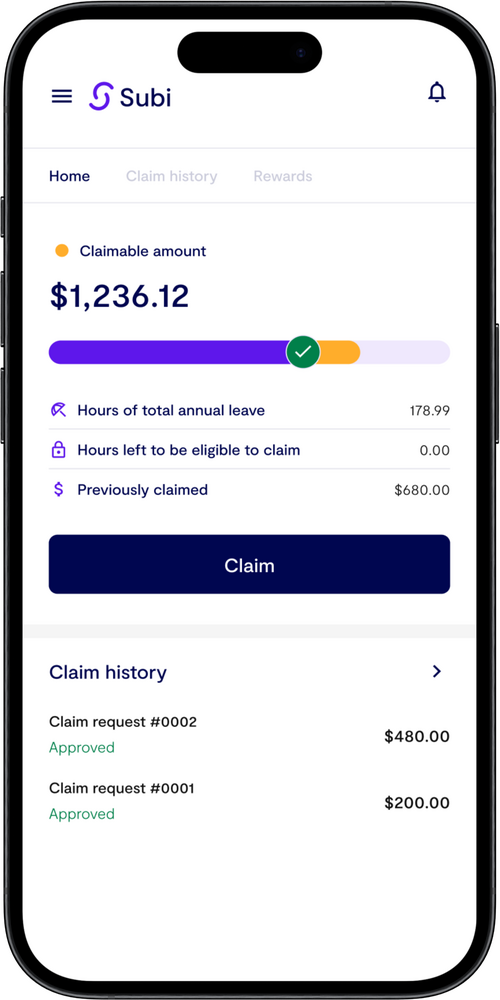

Launched 19 February, Subi is a new fintech platform where employees can claim their annual leave balance in cash.

Employees can claim for outstanding leave that exceeds 20 days (152 hours), regardless of whether their company is registered with the platform.

It's free to use at the moment, for both employees and employers, although there are plans to eventually introduce employer fees.

An annual cash out limit of two weeks' (76 hours) worth of leave applies.

Co-Founder Max Moran says Subi offers a fresh alternative for Aussies who need cash quickly.

"A lot of people are struggling to keep up with everyday costs right now and turning to a credit card is timely but leaves a person fighting high interest payments," he said.

Roy Morgan research suggests Australians have accumulated a record 200 million days of annual leave as of December '23, a record high and a 7.9% increase from September 2021.

Subi for businesses

In accounting terms, annual leave is recorded as a liability (an amount the company owes the employee) on its balance sheet.

If an employee leaves, the outstanding leave balance needs to be paid off, so it's common for companies to encourage, or even put pressure on, employees who have accumulated a lot of leave to take a holiday.

Mr Moran says the feedback Subi has so far received from businesses suggests it is a welcome means to address this dynamic.

"The positive response we’ve received from businesses underscores the importance of giving employees more options and considering how time-consuming running a business is, Subi is an extremely valuable tool in eliminating a tedious task giving managers time to focus on other important jobs," Mr Moran said.

"It’s a win-win scenario for employers and employees as it not only empowers individuals to access earned funds on their terms but also benefits businesses by offering options to staff, be it in the form of forced leave or a timely cash-out on that leave."

Subi has also secured partnerships with accounting software companies like Xero and MYOB so it's easier for businesses to incorporate.

Subi Co-Founders Max Moran and Glenn Rosen

Aimed to provide cost-of-living relief

While interest rates are up and the cost of living remains high, plenty more Australians are likely to experience short term cash flow problems in 2024.

Subi could be a solution for those who have a substantial leave balance built up, but those without, or who have already used their annual two week cash out, are still likely to turn to more traditional means to cover shortfalls.

Short term loans

Some lenders offer short term personal loans, with same day approval, known as payday loans.

These loans generally have smaller maximum loan amounts than normal personal loans, and often have higher fees and rates than normal personal loans.

Credit cards

Given there are more than 13 million credit cards in circulation in Australia, they are presumably one of the most popular ways to meet short term cash deficits.

According to the RBA, the average interest rate on credit cards currently is 18.14% p.a.

However, interest doesn't apply on credit cards when you make your repayments before the interest free period expires.

Sort your spending out

Using a credit card or cashing out on leave can be short term solution to cash flow issues, but this may not address why the problems occurred in the first place.

Budgeting and taking more care with spending can prevent these problems from coming up in the first place.

Anyone who hasn't done a deep dive into their spending habits might be surprised by how much they could save from cutting back on unnecessary costs.