The Reserve Bank of Australia (RBA) has kept the official cash rate at a record low 0.25 per cent for another month at least.

This comes as some in the banking community have called for the RBA to consider moving rates into negative territory, following in the footsteps of Denmark, Sweden and Japan.

It would be an unusual and probably an unlikely move by the RBA, however Westpac chief economist Bill Evans said, "A serious case can be made for the RBA to consider further cuts and entering negative territory for the cash rate if it becomes apparent that the economy is deteriorating even more than is currently expected.

"A small open economy with significant foreign liabilities would certainly see a substantial improvement in the competitiveness of the currency with further rate cuts when other major markets are anchored at their effective lower bounds."

Related Reading

Why interest rates could remain low for years to come and JobKeeper should be extended

How $20,000 could put new home buyers back in the property market

The RBA has so far dismissed the idea saying it has no appetite for negative interest rates, yet RBA governor Philip Lowe's concern around consumer confidence continues to rise.

In positive news, and tempering these concerns, Mr Lowe said, "Over the past month, infection rates have declined in many countries and there has been some easing of restrictions on activity. If this continues, a recovery in the global economy will get under way, supported by both the large fiscal packages and the significant easing in monetary policies."

Mr Lowe was particularly buoyed by improving financial markets, declining volatility and low bond rates. He is also of the belief that "the depth of the downturn will be less than earlier expected."

Backing this sentiment is the easing of restrictions, with states such as Queensland and Tasmania bringing forward its economic recovery. Queensland even wants to see its theme parks open next month. The stabilisation of work hours in May is also welcome, following the high contraction in April where total hours worked declined by an unprecedented 9 per cent: more than 600,000 people lost their jobs, with many more people working zero hours.

The one thing that may slow the recovery is consumer confidence as household spending remains weak. However, there is good news on the consumer confidence front, with the weekly ANZ-Roy Morgan consumer confidence rating rising by 6 per cent to 98.3 points (long-run average since 1990 is 112.9). This is the ninth consecutive week consumer sentiment has lifted.

What do continued low interest rates mean for homeowners and buyers?

It's good news for those already in the housing market and those who want to break in. Banks are battling for the prospective home owner dollar, which is a smaller, thus more competitive market at the moment.

And with the big four generally unable to cut rates further, the Challenger banks are now challenging for their slice of the market, with generally lower rates.

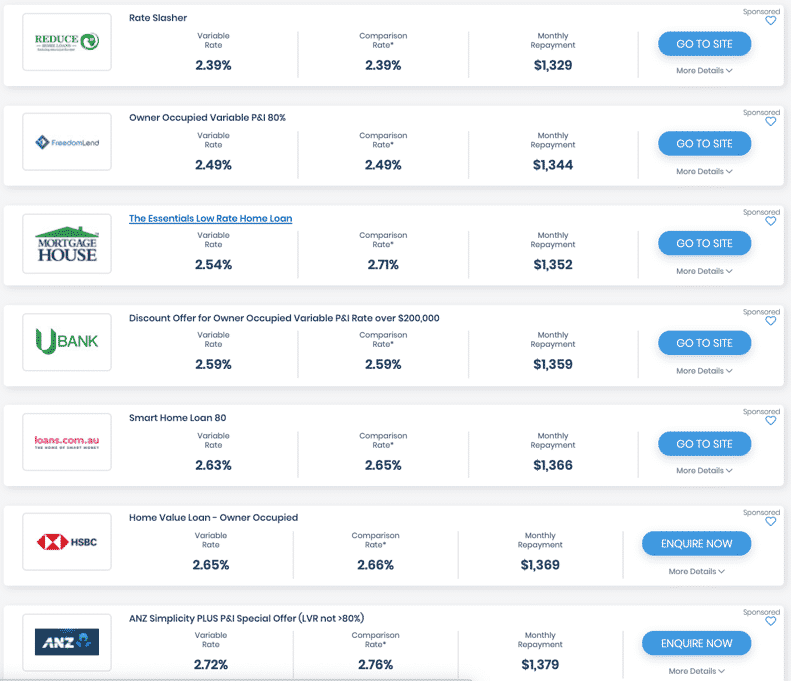

Looking at the InfoChoice comparison of lowest to highest variable rates, you'll find the smaller lenders offering far more competitive rates than the major banks. For instance, Reduce Home Loans has a starting rate of 2.39 per cent, Freedom Lend is offering 2.49 per cent, with UBANK at 2.59 per cent. ANZ is the first on the list for the majors, coming in at 2.72 per cent, with NAB next up at 2.84 per cent.

With lower interest rates on offer and lower repayments, now could be a great time to switch loans or look to break into the market to capitalise on the interest rate environment.

Looking at fixed interest rates, which more and more banks are pushing, you'll find that the big four are offering over half a percent lower than their lowest variable rates in some instances.

That is a big enticement to fix, especially with interest rates unlikely to drop further.

The problem with fixing is the lack of (in some cases) access to an offset account, caps on extra repayments and early pay-out fees.

Bank Australia is offering 1.79 per cent as its lowest rate, ING is at 2.14 per cent and Reduce Home Loans is once again close to the front of the pack with its fixed rate of 2.19 per cent. There are several at this rate, including Mortgage House, Macquarie and Well Home Loans. UBANK (a subsidiary of NAB) and NAB are at 2.29 per cent.

With interest rates so low and likely to stay this way for some time to come, now is the time to start comparing.

This update is not financial advice. This article is general news and information.

Home Loans: The comparison rates are based on a secured loan amount of $150,000 and a term of 25 years.

Personal Loans: The comparison rates in this table are based on a loan of $30,000 and a term of 5 years unless otherwise indicated in the product name with^, in which case, the comparison rate is based on a loan of $10,000 and a term of 3 years. The comparison rates are for unsecured personal loans only for the relevant amounts and terms. The comparison rates for car loans and secured personal loans are for secured loans unless indicated otherwise.

WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan. Comparison rates are not calculated for revolving credit products.

The products compared in this article are chosen from a range of offers available to us and are not representative of all the products available in the market and influenced by a range of factors including interest rates, product costs and commercial and sponsorship arrangements

InfoChoice compares financial products from 145 banks, credit unions and other financial institutions in Australia. InfoChoice does not compare every product in the market. Some institutions may have a commercial partnership with InfoChoice. Rates are provided by partners and taken from financial institutions websites. We believe all information to be accurate on the date published. InfoChoice strives to update and keep information as accurate as possible.

The information contained on this web site is general in nature and does not take into account your personal situation. Do not interpret the listing order as an endorsement or recommendation from us. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. If you or someone you know is in financial stress, contact the National Debt Helpline on 1800 007 007.