Despite data trends pointing to a supposed shrinking of dwelling prices, the median property values Down Under continued to move upwards, rising 0.4% to $759,437 in January.

The January read marked the 12th consecutive month of value increases.

“Certain economic indicators are usually telling of where the housing market is going,” CoreLogic head of research Eliza Owen said.

“But through the pandemic and beyond, some data relationships fell apart, with the housing market recovery in 2023 defying interest rates and low consumer sentiment.”

Migration-driven demand drives prices up despite rate hikes

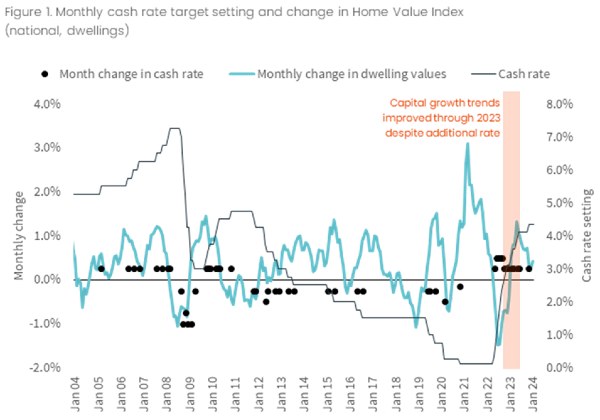

Historically, interest rates and home values have an inverse relationship – when rates rise, home prices fall off the back of low housing demand due to reduced borrowing capacity and high mortgage costs.

The opposite is true in that when the cash rate falls, property prices tend to rise.

RBA’s series of rate hikes since May 2022 has lifted the cash rate from a pandemic low of 0.1% to its current peak at 4.35%.

Initially, property prices had a strong reaction to rate rises, falling 7.5% between April 2022 and January 2023.

However, by November, home values rebounded to new record highs, coinciding with five further cash rate increases in 2023.

Source: CoreLogic

An increased demand from Australia’s growing population, buoyed by a surge in net overseas migration from mid-2022, was seen as the reason that steered the upswing of property prices.

Overseas migration soared to 518,000 in 2022-23.

“Housing demand has been buoyed by high migration, but also tight rental markets that have probably incentivised renters to transition towards homeownership if they can afford to do so,” CoreLogic research director Tim Lawless said.

Tight rental markets, slow approvals contribute to rising home values

Limited rental supply and slow building approvals also put pressure on housing values.

“Tight rental markets may have also been at play, with unusually high rent growth and low vacancy rates prompting more people to purchase housing,” Ms Owen said.

Data from Domain showed vacancy rate across the country tightened to 0.8% in January, with all capital cities reporting declines.

Meanwhile, new dwelling approvals failed to meet the average yearly target of 220,000 homes as the total number of houses approved for construction only reached 162,000 in 2023.

“Building approvals plunged 9.5% in December, pointing to weak home construction ahead and a continuing housing shortage,” AMP chief economist Shane Oliver said.

Housing finance falls despite rising prices

The soft home lending data also appears contradictory to the consistent rises in home values.

The latest ABS lending report revealed the value of new home loans fell 4.1% in December.

Falls were recorded in both owner-occupier and investor loan commitments, plunging 5.6% and 1.3%, respectively.

Housing credit growth also remained subdued, posting a modest 0.4% monthly gain in December to bring the annual growth rate to 4.8%, well down from the 7.7% growth in the prior year.

Despite the unusual disparity, one only needs to look at the ongoing housing undersupply to understand the ongoing situation.

“It does seem odd – record home prices but housing finance and related credit growth are far from it,” Mr Oliver noted.

“It’s because overall transactions have been relatively low compared to the last boom – partly reflecting lower listings but also relatively fewer buyers.”

Aside from the fundamental demand for homes, the market’s capacity and desire to purchase are also notable factors that affect home values.

“Prices are still determined by supply and demand, and while buyer demand has been more constrained, with supply constrained too, prices still go up,” Mr Oliver added.

“You could argue that this means the rebound in prices has come with less conviction than in the past – in share market parlance, it’s come with less breadth and volume which is often a sign of weakness.”

How homebuyers are funding their purchases could be another possible reason explaining the decoupling between prices and lending data.

“I suspect that access of the ‘bank of mum and dad’ and prior saving buffers have played a bigger role in the upswing in the last year than normal,” the bank economist said.

Sales volumes depart from consumer sentiment

Consumer sentiment is another indicator telling where the housing market is going. A low index number below 100 indicates pessimism, and vice versa.

Last year marked the lowest average monthly reads since the early 90s recession.

Though buyer sentiment trended in line with dwelling sales in the first half of 2023, the rolling six-month average sales in the second half diverged from the consumer sentiment when the former rose 27.6% while the latter plunged 2% in October.

“Tight rental markets, strong population growth, and active buyers who are less reliant on housing credit may have played a part in pushing sales volumes higher in the spring of 2023,” Ms Owen said.

While sentiment remains firmly pessimistic, a slight lift in February suggests an improving outlook is emerging among consumers.

The Westpac-Melbourne Institute (MI) index found consumer sentiment rose 6.2% to 86 last month.

While the figures were a far cry from the historical average of 124.7, the February gain is said to offer “the most promising sign yet” that the cost-of-living pressures are starting to ease.

“With soft housing finance and housing credit growth and depressed sentiment towards property – as evident in the response to whether now is a good time to buy a dwelling in the Westpac/MI survey – it’s very hard to argue that the rebound in prices over the last year has been a bubble,” Dr Oliver said.

However, we might not see how long housing values and sales can defy interest rates as early indicators suggest market conditions are heating up again.

Easing inflation and rate cut expectations (pre-RBA announcement) are said to be driving the boost in sentiment among consumers.

“it is worth noting that confidence was lower post the RBA meeting than prior; those surveyed before had a sentiment read of 94.1 and those surveyed after had a sentiment read of just 80 – a 15% swing,” NAB head of market economics Tapas Strickland said.

“It is likely the RBA’s less dovish tones – relative to some expectations – were a factor.”

Ms Owen added the high auction clearance rates at the beginning of 2024 could provide an early boost to market conditions throughout the year; Melbourne is one of the more prominent examples where supply is currently matching demand, leading to soft price growth.

Photo by Kindel Media on Pexels