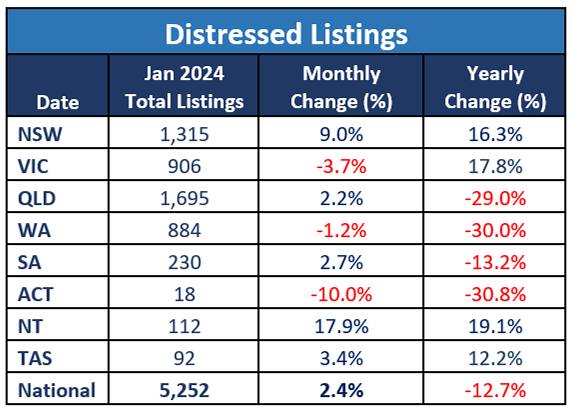

Distressed property listings at the beginning of the year totalled 5,252, which is 2.4% higher than December last year.

As per SQM Research, distressed listings include mortgagee-in-possession properties, divorcee properties, deceased estate, and anything that indicates a must-sell situation.

Such listings are typically sold at lower prices, making them an attractive option for property bargain hunters.

Queensland has the largest supply of residences under distressed conditions at 1,695, up 2.2% in January.

Monthly increases were also recorded in South Australia (up 2.7%), Northern Territory (up 17.9%), and Tasmania (up 3.4%).

Although Victoria’s distressed listing activity eased 3.7% in January, it was up 17.8% over the past 12 months.

Notably, New South Wales has posted growth in distressed listings activity monthly, by 9%, and annually, by 16.3%.

Data source: SQM Research

Market warned: Don’t get ahead of yourself just yet

“The 9% rise in NSW for the month was very abnormal and suggests some vendors in NSW are increasingly desperate to offload their properties.” SQM Research managing director Louis Christopher said.

These figures may be favourable to buyers on the lookout for discounted properties, especially considering median house prices in NSW, particularly in Sydney, have hit record highs at nearly $1.6 million for houses and $800,000 for units.

However, Mr Christopher advised both buyers and sellers against making any impulsive moves.

“Yes, it may be a positive sign. Yes, there may be an interest rate cut at some time this year. However, the market right now is very mixed, and vendors need to realise that buyers will be sensitive to any economic slowdown that may be presently occurring,” he said.

With inflation tracking towards the RBA target band, major bank economists have predicted interest rate cuts happening in the second half of 2024.

Yesterday, the RBA announced its decision to maintain its current holding pattern, keeping the interest rate unchanged at 4.35% in February.

Though the central bank has softened its tightening bias, the Board is determined to keep its options open given inflationary risks, saying that “a further increase in interest rates cannot be ruled out”.

Nevertheless, industry experts said the Reserve Bank’s February announcement would benefit the housing market.

“Greater confidence around where interest rates are sitting should support further recovery in buyer and seller confidence,” PropTrack economist Anne Flaherty said.

A better outlook for February

Given the 31% increase in scheduled auction events this week, Mr Christopher is optimistic that February will set to record substantial rises in property listings.

“There are 2,516 scheduled auction events across the country…suggesting an abnormally strong start to the auction year which will feed through into much higher total listing counts for February,” he said.

The total property listings across capital cities was 220,956 in January, down 5.7% versus the previous month.

Monthly declines were recorded in all cities, which Mr Christopher said was expected, as January is traditionally a quiet time for listings.

“The country recorded a typical January hiatus in the housing market. However, forward listings suggest that February will be a very strong month for housing activity,” he said.

Photo by Pavel Danilyuk on Pexels