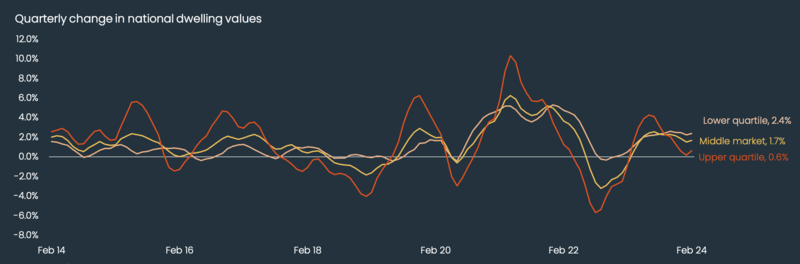

CoreLogic’s monthly housing report found cheaper homes, or those in the lower quartile, are increasing in value at four times the rate of those in the upper quartile.

That’s 2.4% (lower quartile) versus 0.6% (upper quartile). Meanwhile, prices of properties in the broad middle market rose 1.7%.

While this could be good news for entry-level homeowners, this means it might be harder for Australians looking for cheaper homes to crack into the market.

Historically, the upper quartile of the market tends to lead the cycle, both the upswings and the downturns; it was noted most recently in the first seven months of 2023.

Lower quartile value homes are rising faster than broad middle and upper quartile markets. (Data source: CoreLogic)

“This trend is most evident in Sydney, Melbourne, and to a lesser extent Brisbane, where upper quartile values clearly led the 2023 upswing through the first half of the year,” CoreLogic research director Tim Lawless said.

However, prices of expensive dwellings have been slowing sharply since the second half of 2023 and into early 2024, while affordable homes “have consistently recorded a faster pace of capital gains”.

This pattern is most notably apparent in Perth and Adelaide, where homebuyers shopping – or perhaps hoarding – affordable homes are pushing the prices of lower quartile properties up.

Perth's home prices in lower quartile went up 6.4% in the three months to February, higher than the 4.2% increase in luxury home value, translating to a 2.2% difference. In Adelaide, the gap is 1.6% (4.8% vs 3.1%).

The price difference between lowest and highest value homes in Brisbane is 1.5%, while Sydney and Melbourne posted 0.7% price gap and Darwin and Hobart at 0.6%.

Why Perth homes are popular among buyers

Perth and parts of regional WA have been enjoying their time in the spotlight being a favourite of investors on account of the market’s affordability relative to other regions.

“These regions are generally benefitting from comparatively lower housing prices and positive demographic factors that continue to support housing demand,” Mr Lawless said earlier this year.

Recent data revealed home values in Perth have been leading the price leap, both monthly (1.8%) and annually 18.3%), among other capitals.

The median home value in Perth as of end-February was $687,004 – lower compared to Melbourne ($778,941), Brisbane ($805,593), and nearly two times below Sydney where the median price of houses stood at $1,128,155.

This has led buyers scrambling to beat others in snapping up Perth homes that only spend an average of 12 days in the market – the fastest of all capitals.

By comparison, combined capital city homes took approximately 32 days to sell, according to data gathered over the three months to February.

“The relative affordability of the city’s homes, population growth, and very tight rental markets are also supporting [price] growth,” said PropTrack senior economist Eleanor Creagh.

Latest vacancy rate data revealed Perth has one of the tightest rental markets across the country, with a critical vacancy rate of 0.3%, tied with Adelaide.

Consequently, monthly rents in Perth have gone 13.9% higher (up 12.1% in regional WA) compared to last year.

How long will it take to enter the housing market?

Domain’s recent First Home Buyer Report revealed it now takes couples aged 25 to 34 two months less to save for a 20% deposit on an entry-level house.

However, given the noted trend of entry-level home prices outpacing luxury properties, the national average runs contrary if we look at specific cities.

Going back to the current property market darling, it actually now takes three years and 10 months – or four more months compared to last year – to save for a 20% deposit on an entry-level home in Perth.

The same annual increase in the deposit saving timeline was noted in Brisbane, where it takes young couples five years and two months to save for a starter house.

Looking five years further, first home buyers need to save for one more year to break into Brisbane’s housing market.

Adelaide, which is one of the cities with the fastest price increase of lower quartile properties, also recorded the highest annual and five-year changes in deposit saving timeline, which has been extended to five more months and 15 months, respectively.

As it stands, young couples will need five years and one month to build a 20% deposit and avoid taking out a lenders mortgage insurance (LMI) if they want to buy an entry-level home in Adelaide.

Photo by Redd F on Unsplash