- Australian banks have passed three quarters of the RBA's cash rate increases on to depositors during its latest hiking cycle

- Meanwhile, borrowers are being hit harder than their international counterparts thanks to the nation's apparent fondness for variable rate loans

- Customers should be aware that the majority of the most compeitive interest rates on Australian savings accounts right now are bonus rates rather than base rates

Australian banks have passed on the majority of the dozen cash rate hikes implemented during the current cycle to depositors, new data from the Reserve Bank of Australia (RBA) reveals.

The RBA lifted the cash rate from 400 basis points to 4.10% over the 13 months to June 2023, damaging the financial positions of borrowers across the nation but potentially bolstering those of savers.

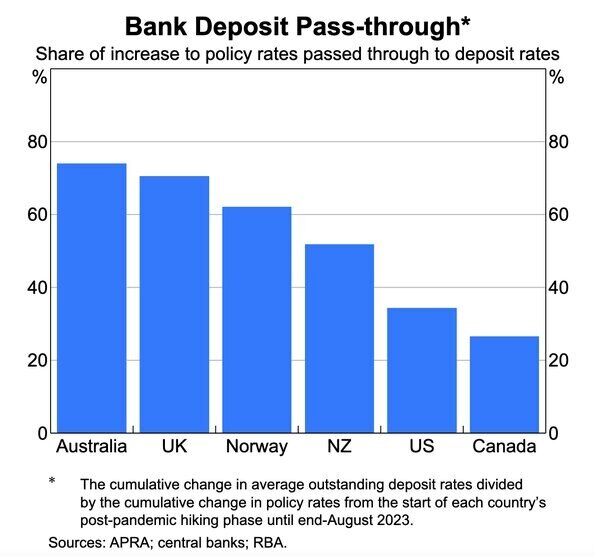

“Since May 2022, Australian banks have passed on about 75% of the increase in the cash rate to deposits, which is in line with past phases of rising interest rates,” said Christopher Kent, RBA assistant governor of financial markets.

“In fact, the extent of this pass-through to deposit rates has been relatively high compared with other economies.”

“In New Zealand, for example, the equivalent figure is about 50%, while in the United States it is about 35%.”

Image courtesy of the RBA.

The average rate on online Australian savings accounts has quadrupled since the beginning of the latest rate hiking cycle, lifting from 0.5% in April 2022 to 2.0% in September 2023.

Higher interest rates offered to depositors likely reflects Australia’s larger share of variable rate loans, Dr Kent noted.

Because of that, Aussie borrowers are likely being impacted more than those in other global economies.

“Many borrowers have had to cut back on spending to meet higher mortgage payments, while also feeling the pain of rapidly rising living costs,” Dr Kent said.

“This has led to slower growth in demand for goods and services.”

Therein lies a large part the RBA’s strategy to tackle inflation, as reduced demand will likely drive prices lower across the economy.

On the other hand, households with notable savings balances could be earning more interest and, in turn, increasing their spending.

While that has the potential to counteract the effect of rising rates, any such impact is expected to be minimal.

“The stock of household debt in Australia is larger than the stock of household savings,” Dr Kent said.

“Since rates have been rising, the contribution of interest received by those with savings to the growth of disposable income has been noticeably smaller than the extra interest payments made by those with debt.

“Moreover, people with savings typically spend less of each extra dollar they earn than those with debt, so any additional spending associated with extra interest received is not enough to offset the reduction in spending associated with extra interest paid.”

Bonus interest far outweighs that of typical savings accounts

As the above chart shows and InfoChoice’s market research confirms, savings accounts that offer bonus interest rates to depositors generally generate far greater returns than traditional savings accounts.

Note: The below interest rates are correct as of the time of writing and are subject to change at any time

While there are outliers – the 5% p.a. base rate on Unity Bank’s MoneyMAX savings account or the 4.5% p.a. interest rate on Macquarie and Bank of Queensland’s basic savings accounts for instance – the majority of competitive savings accounts demand customers regularly meet conditions to realise above-average interest.

Such conditions might be minimal (a customer might need to make a single transaction or a relatively small deposit into their savings account each month) while others could be comparatively demanding.

Take the current market leader for example.

ME Bank’s HomeME savings account will provide eligible deposits with a 5.65% interest rate, as long as they deposit $2,000 into their savings account and grow their balance each month.

If they fail to do so, their monthly interest rate will default to a 0.55% p.a. base rate.

The ACCC is aware of this behaviour and is set to finalise its report into deposits and conditions at the end of the year.

Image by Towfiqu barbhuiya on Unsplash.